There are various companies that are linked to the former vice-president of Angola and we will begin by highlighting those that the Angolan State has recently recognised as such.

Lektron Capital, formerly called Global Finance, is a private limited company created in 2011 whose main activity, according to its articles of association, is “the management of shareholdings in other firms as an indirect form of exercising economic activities”, in addition to the provision of corporate services and “any other related activities not prohibited by law”.

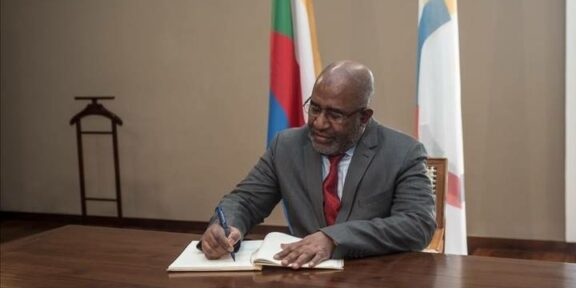

The business concept of a private limited company in Angola is that of an offshore company: the firm’s owners are not registered in the Diário da República (an official Angolan publication), the register containing their names is therefore kept secret. This is the case with Lektron Capital. However, the investigations carried out by Angolan journalists long ago have already denounced Manuel Vicente as the ultimate beneficiary of the company. This fact has always been denied by him, until the National Asset Recovery Service of the Attorney General’s Office finally confirmed it in a press release that was issued last June. The press release states that the ultimate beneficiaries of Lektron are Manuel Domingos Vicente and Manuel Hélder Vieira Dias Júnior.

As part of a national campaign to recover assets, the Angolan Attorney General’s Office (PGR) identified Lektron Capital as one of the beneficiaries of public funding carried out by the State in recent decades. This firm received US$125 million from SONANGOL upon its creation and then proceeded to use such money to buy part of Banco Económico, formerly Banco Espírito Santo – Angola (BESA). In other words, Manuel Vicente, as SONANGOL’s Chairman, loaned money to Lektron Capital, his company, to buy Banco Económico, his bank, of which he holds 30.9% of. The illegality in such transactions is all too evident, a sequence of promiscuous acts of misconduct, that were covered up by the former president José Eduardo dos Santos and ignored by the Angolan justice system.

Manuel Vicente, vice-president of Angola at the time, was clearly linked to the transformation of BESA into Banco Económico which took place on October 20, 2014. He attended the meeting through his deputy and renowned frontman Zandre Campos Finda, on behalf of the companies Lektron Capital and Portmill. On that day, unfortunate circumstances befell on the “bad BES”; the division of BES into two entities that made by the Bank of Portugal in August 2014. This caused the the 55.71% it held in BESA drop to zero, and the New Bank, BES’s replacement in Portugal, holds only 9.7% of the capital of Banco Económico in Luanda.

Portmill Investimentos e Telecomunicações is another company with links to Manuel Vicente, also involved in the aforementioned case against the Portuguese attorney. This firm was the main beneficiary of the privatisation of the Angolan telecommunications company Movicel by acquiring 59% of the capital, in partnership with Modus Comunicare.

In the report “Presidency of the Republic – The corruption’s epicenter in Angola”, Rafael Marques de Morais explains how the privatisation was carried out. On 26 August 2009 the council of ministers, headed by José Eduardo dos Santos, decided to privatise Movicel without a public tender. Two months earlier, Manuel Vicente and Generals Manuel Hélder Vieira Dias “Kopelipa” and Leopoldino do Nascimento “formally withdrew from the society they owned, with 99.96% of the shares equitably divided between them”. The new owner, with 99.9%, was Lieutenant Colonel Leonardo Lidinikeni, official of the presidential escort at the time, Being an official of the presidential escort meant that he had a relatively lower ranking and status when compared to the then Minister of State and Head of the Military Staff Manuel Hélder Vieira Dias “Kopelipa”, who participated in the council of ministers, together with Manuel Vicente as the oil company chairman.

The Companhia de Bioenergia de Angola (BIOCOM), a consortium created in 2007 by the Brazilian multinational Odebrecht, Damer Indústria and SONANGOL Holdings, is another debtor company of the Angolan state targeted by the Luanda government in the asset recovery campaign. The Attorney Generals’ press release omitted the actual Angolans benefiting from this company. It is the triumvirate of all time: Manuel Vicente and Generals Manuel Hélder Vieira Dias “Kopelipa” and Leopoldino do Nascimento, through Damer Indústria, which was created just three months before BIOCOM, in July 2007, as Marques points out in the aforementioned report.

As is common in major investments approved by the Council of Ministers when it comes to joint ventures between foreign multinationals and private Angolan companies, a considerable part of the share capital is reserved for high-ranked officials. Damer Indústria S.A which was incorporated on 26 July 2007, belongs equally to Generals Manuel Hélder Vieira Dias Júnior “Kopelipa” and Leopoldino Fragoso do Nascimento in association with Manuel Vicente, President and Chairman of the Board of Directors of Sonangol.

In 2009 the council of ministers approved the creation of the Agro-Industrial Unit of Cacuso; a project in Malanje for the cultivation and production of sugar cane which was expected to supply the country with sugar, alcohol and electric power. For this purpose, 272.3 million dollars were injected into it. The three companies mentioned above were in charge of the project, therefore establishing BIOCOM. And so, once again, we have Manuel Vicente, SONANGOL Chairman of the Board, using the subsidiary SONANGOL Holdings to engage with public money in a business transaction where he is part of Damer Indústria.

The Database of Effective Owners of Angola has 28 companies associated with Manuel Vicente. Among the aforementioned 28 companies lies the Banco Angolano de Investimentos (BAI), of which he owns 5% through an offshore company called ABL, as was mentioned by Marques who cites a US Senate report that was published in 2010.

BAI, recently ranked as the largest commercial bank in Angola has SONANGOL as its majority shareholder, therefore assuming the position of vice-chairman on the board of directors. Manuel Vicente, once again, appears to represent the oil company, while also representing private interests of his own.

The oil company Nazaki is another firm that belongs to Manuel Vicente, in partnership with Generals Kopelipa and Leopoldino do Nascimento. Nazaki has a JV with the American company Cobalt, owned by Goldman Sachs and Carlyle. In the book “The Angolan Owners of Portugal”, Jorge Costa, João Teixeira Lopes and Francisco state that aforementioned explore oil in block 9 and 12.

Cochan S.A. is another company in association with Manuel Vicente. This company was registered in Angola on the 6th of April 2009 and owns several branches. With a wide corporate scope, Cochan S.A. owns another company; Pumangol. Marques considers this as the “the most influential intermediary in the sale of Angolan oil, as well as in the distribution of fuel in the country”.

Zandre Finda, Vicente’s well-known front man is among the formal shareholders of Cochan S.A.. He is the executive director of the aforementioned Nazaki, also belonging to Vicente.

International criminal relations

Manuel Vicente has a vast international network of personal relations, which includes individuals already convicted or linked with ongoing cases in different countries. A prime example would be that of the three people involved in the so-called “Operation Fizz” in Portugal, namely Orlando Figueira and the lawyers Proença de Carvalho and Paulo Blanco.

There are also those who have been secretly sentenced to life imprisonment. Sam Pa, one of several names of a Chinese businessman who for years was the main link between Angola’s business deals with China, was arrested in October 2015 on suspicion of corruption. The business group he headed, called Queensway Group, has links to several international companies in Angola, such as Total, BP, Glencore and also with China Sonangol International Holding (CSIH). It is in the latter that “Mr. Oil” appears as the director of the Hong Kong-based company, having even carried out such a role simultaneously while being vice-president of Angola, despite such being forbidden by constitution

CSIH ownership comprises of Dayuan International Development Limited with most of the ownership, 70%, and SONANGOL owning the remaining 30%. Dayuan is owned by another firm, New Bright International (NBI), which holds 70%, with the remaining beneficiary belonging to the Chinese Wu Yang, who used the address of the Chinese secret services to register his companies, which are associated with SONANGOL. In addition, two other Chinese citizens are the owners of the NBI, and all of these are associated with the convicted friend of Manuel Vicente – Sam Pa.

British journalist Tom Burgis, author of the book “The Pillage of Africa”, tells of a Hollywood feat between Sam Pa and Manuel Vicente. Registered as António Sampo Menezes in Angola, Sam Pa landed in Guinea Conakry in 2009 with the purpose of expanding his businesses to that territory. The Minister of Mines and Energy at the time, Mahmoud Thiam, was the one who received the entourage, which also included Lo Fong Hung, partner of Dayuan. Thiam informed President Moussa Dadis Camara (2008 – 2010) and immediately decided to investigate the Chinese businessmen.

Coincidentally, Thiam knew “Mr.Oil” from his time working in banking, and so Sam Pa used such connections to try and sidestep such investigations by making mention of his close friendship with Manuel Vicente.

Upon hearing of Manuel Vicente, he was stunned and concerned, thereby challenging Sam Pa to return to Conakry with his friend from Luanda. “If you are such friends of Manuel Vicente, come back here with him” he said. Sam Pa surprised the government when three days later he landed in Conakry on the same plane alongside Manuel Vicente, and on the same day they were received by President Dadis.

Dayuan, formerly Beya, formed China International Fund Limited (CIF) in 2003 “to manage the credit lines and reconstruction projects under the Office of National Reconstruction, headed by General Kopelipa” as is stressed by Rafael Marques de Morais on its popular website ‘Maka Angola’. In the middle of CIF, amongst other deals, another “old friend” of the Angolan presidency emerges: the Franco-Angolan arms dealer Pierre Falcone, who even served a prison sentence in Paris. Together, Manuel Vicente and his friends form a criminal cartel dedicated to pillaging the wealth of the Angolan state.

In Portugal, there is a considerable amount of people with ties to Vicente, even if they are weak links. This is the case of Armando Vara, former finance minister in José Sócrates’ government. Currently sentenced to five years in prison for three crimes of influence peddling in the “Face Oculta” case, Armando Vara crossed paths with Manuel Vicente when he was vice-president of the BCP bank in Portugal, of which SONANGOL is a 19.4% shareholder.

The almighty in the upper city palace

Although several personalities of the previous administration led by José Eduardo dos Santos have been investigated for corruption, Manuel Vicente, proven to be corrupt by a magistrate in Portugal, remains untouchable in Angola.

He is a congressman for the MPLA party, and a member of its central committee, but has also been referred as a special advisor to President João Lourenço on oil issues, which gives him direct access to the presidential palace located in the upper city of Luanda.

Discreet as ever, “Mr. Oil ”, who is no longer “the irritant” in the relations between Angola and Portugal, proves to be an excellent political falcon. His “godfather” José Eduardo dos Santos is also one of those targeted by the anti-corruption speeches made by João Lourenço, who called them “marimbondos” or ” Homeland Traitors”. The climate of conflict between Lourenço and José Eduardo dos Santos reached the point where the latter refused to travel by plane provided by the state, even with the direct intervention of the president.

As a response to the list of companies that benefited from public funds published by the office of the attorney General, Manuel Vicente’s Lektron Capital “voluntarily handed over the shares [that it held in the Economic Bank] to the Angolan state,” said the Attorney General of the Republic.

All the evidence of illicit enrichment, corruption, embezzlement and criminal association that we have listed does not seem to be enough for the Angolan Attorney General to initiate criminal proceedings against Manuel Vicente, nor for the president to keep him away. He has been singled out as the richest man in Angola, the keeper of important financial information, therefore making him indispensable to President Lourenço at present.

This investigation was carried out with the support of the Global Anti-Corruption Consortium and of Transparency International Portugal.